TWE Becomes the New Importer of Mouton Cadet

Write | WBO Morris Translate and Edit | WBO Kiwi

Recently, TWE announced it has become the exclusive importer of Mouton Cadet in mainland China. But in the past years, Mouton Cadet had been imported and distributed by Torres in China market, who still holds shares in Torres China.

TWE, the owner of Penfolds, announced they had reached long-term strategic cooperation agreement with Baron Philippe de Rothschild, starting from January 2018, they will begin to import and distribute brand portfolio led by Mouton Cadet and Chilean Escudo Rojo in mainland China.

On hearing this news, WBO contacted with Gaila, Brand Communication Executive of TWE in China. She confirmed that Mouton Cadet has changed from Torres to TWE.

The cooperation relationship was done after 14 years

According to WBO, Torres began distributing products under Baron Philippe de Rothschild including Mouton Cadet from the year of 2003. In 2007, Baron Philippe de Rothschild invested and became one of the share holders in Torres China. That is to say, Torres has been operating Mouton Cadet in its business for 14 years.

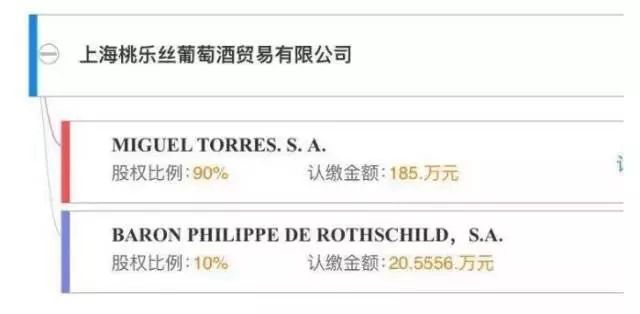

As data shows, Baron Philippe de Rothschild still has 10% proportion of total shares in Torres China (CNY 205556), indicating that the cooperation between the two sides is very close then, now suddenly make this out, which indeed surprised many wine companies interviewed by WBO.

Equity ratio of Torres and Baron Philippe de Rothschild

Talking about their broke up, Fang Yi, general manager of Puyi Fine Wines in Changsha,analyzed: This shows both sides feel dissatisfied with each other, and the premise is the bad job in wine sales and marketing performance in China.

Another wine business observer Liu Fengwei also pointed out: Torres can’t satisfy with Mouton Cadet’s higher pursuit which can be achieved by TWE, and that’s why their relationship came to an end.

“Although Chateau Mouton Rothschild is one of the five premium wineries in Grand Cru Classe system, but its popularity in Taiyuan is relatively weak, coupled with the importer's new policy and limited profit, whose price is also not strong enough to compete with that of DBR Lafite's commercial brand Legend and Saga. That's why distributors were not active in pushing Mouton Cadet.” said Mr. Gao, a distributor of Mouton Cadet based in Taiyuan, Shanxi province.

As for reason hidden behind the break up, Alberto Fernandez, director of Torres China, replied in the interview with WBO: Torres and Baron Phillipe de Rothschild has decided to part ways in China due to differences in the manner of approach in this market. Hence, Torres will become the sole owner of the Torres subsidiary in China and in a few weeks, will announce the new distribution of an outstanding premium Bordeaux family producer, amongst other new brands in the Chinese market.

TWE owns double identity, both brands owner and importer

TWE moves frequently in recent years in the China market, mainly promotes Australian wine brands suchas Penfolds, Wolf Blass. It has launched several fine wines from Napa Valley last year. During VINEXPO this year, TWE released its new brand Maison de Grand Esprit targeting at China and other Asian markets. However, announcement of the exclusive agency for Mouton Cadet in mainland China, shocked many importers and distributors.

In addition, TWE also confirmed its strategy of setting storehouse in China. According TWE’s statement, in order to ensure wine supply and rising consumer demand in the future China market, TWE planned to set up new self-managed storage facilities in Shanghai, and will be put into use at the end of 2017.